Inflation eases and demand levels out in Retail Produce

- YTD, the difference between the growth rates for dollar sales and volume sales continues to narrow

- Thru 20 weeks, volume has seen a slight decline (-0.7%) and dollars have seen nominal growth (+1.2%)

- As Fresh Produce inflation rates ease, higher Inflation rates continue in Grocery Center Store

Regional Performance YTD (20 weeks)1

The Southeast and West Regions are showing volume growth YTD, while the South Central and California regions are showing the largest volume declines.

Top 10 Fruit and Vegetables $ (millions)1

- YTD, berries maintain share leadership, but melons are now the top performing fruit thus far with +6.7% in dollars & +6.1% in volume

- Potatoes are doing well from a dollar sales perspective, but volume is down

- Onions are the only vegetable growing both dollars and volume

Top Grocery Retailers for SNAP Shoppers5

- Our partners at Numerator conducted a recent survey of SNAP participants

- Households who consistently use SNAP benefits are much more likely to opt for low-cost retailers

- 96.9% of SNAP shoppers purchased groceries at Walmart in the past year, spending an average of $2,290

- Different shopper demographics leads Sam's to index higher than Costco within the Club channel

- Low-price retailers like Dollar General, Dollar Tree and WinCo Foods capture roughly twice as much share among SNAP vs. Non-SNAP shoppers

As Foodservice traffic recovers, the share of meals being prepared at home remains elevated3

- The share of total meals prepared at home peaked during the pandemic, when over 84% of meals were prepared at home

- We are seeing that consumers developed new habits for eating that are now lingering well after pandemic concerns have dissipated. Given the economic environment, the cost savings associated with eating at home has become a factor. Currently, roughly 80% of meals are prepared at home, as compared to the estimated 53% that were prepared at home pre-pandemic

A Price to Play1

Inflation continues to ease with total produce is trending at 2.0% thru 20 weeks. Fruits came in below PY at (0.9%), while vegetables came in higher at 4.9%.

76% of Shoppers have noticed Shrinkflation... and it has impacted shopping behavior4

- 14% switched to the store brand

- 16% Delayed purchase until the product went on deal

- 25% Decided not to buy

- 27% Did not change their purchase

- 5% Change to a different brand

- 7% bought a different type of product instead

- 4% bought a larger size or additional package of the same product

Inflation’s impact on Fresh Produce demand was significant1

Independence Day 2023 – Consumer Expected Behavior3

87% of Consumers plan to celebrate Independence Day this year (+9 pts vs LY)

- Over half of those consumers (58%) plan to grill or BBQ over the holiday weekend

- Just under 30% plan to cook or bake

Food is the number one item that celebrators plan to purchase

- 83% of celebrators plan to purchase food specifically for the holiday

- 47% plan to purchase alcoholic beverages, while 34% plan to purchase non-alcoholic beverages

Two-thirds of Independence Day Shoppers plan to spend the same amount as LY

- 50% of celebrators plan to spend between $25 and $75 on this year’s celebrations

- 19% of celebrators are planning to spend less than last year

Independence Day celebrators are looking for money saving measures

- Over half of celebrators (52%) plan to buy items on sale, while 27% plan to use more coupons

- Nearly a third of celebrators (31%) plan to prepare budget-friendly foods

- One-fifth of celebrators plan to shop at Dollar or Discount Stores

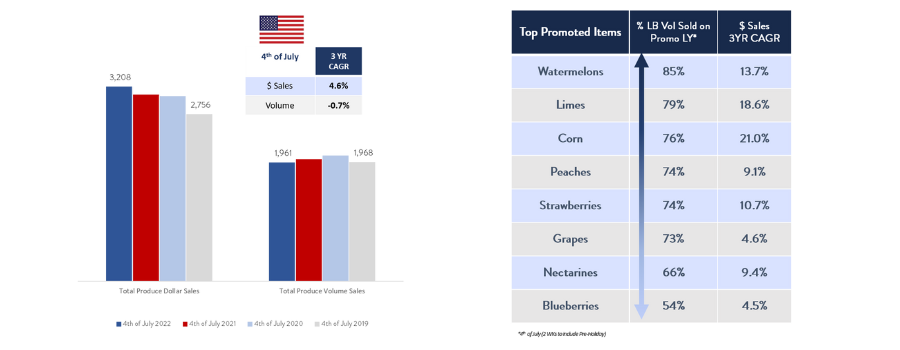

Total US Fourth of July produce performance1

- Circana Integrated Fresh, Total US, MULO, Calendar Year 2023 Ending 5.21.23

- Circana Panel Data, Total US- all outlets, Calendar Year 2023 Ending 5.21.23

- Numerator 2023 Q2 Holiday Preview

- Circana Shopper Survey April 2023

- Numerator: Top Grocery Retailers for Snap Shoppers Scorecard, May 2023