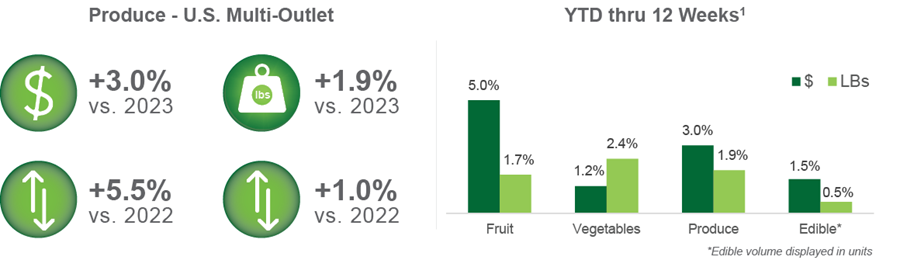

The produce department continues its momentum through the first 12 weeks of the year, providing welcomed stability in the market.

- With dollar sales up 3% and LBs up nearly 2%, produce is outpacing total edible performance

- The produce uptick has been driven by impressive dollar sales growth in fruit and increased volume demand in vegetables

- Channel shifting within market continues, but at a slower pace

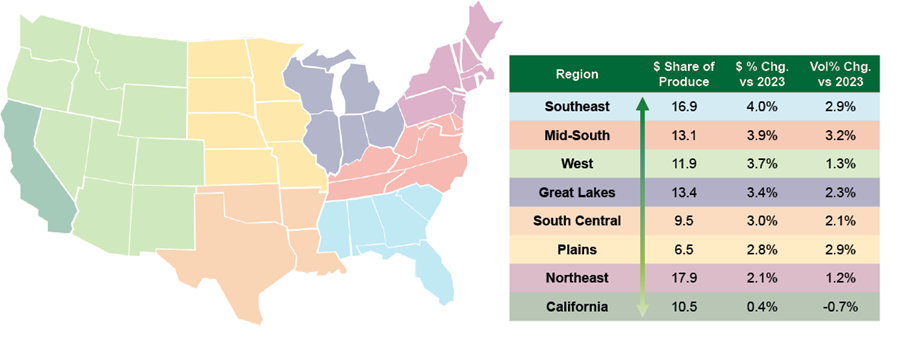

Regional product category performance YTD (12 weeks)1

The Southeast continues to lead all regions in growth.

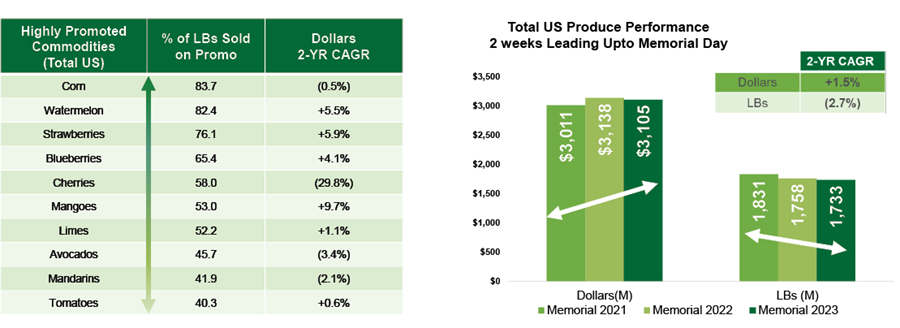

Top 10 fruit and vegetables in the produce category YTD1

($ Sales)Healthy snacking and at-home cooking trends continue to impact fresh produce growth.

Commodity spotlight: melons

Melon demand peaks in summer, driven by consumer cravings for juicy, refreshing fruits. Key holidays like Independence Day and Labor Day further boost melon sales, especially watermelons—a staple at picnics and barbecues. The rise of cut melon options adds convenience and drives growth and margins in this category. So, whether you’re biting into a watermelon wedge or savoring a sweet cantaloupe, melons define the season.

Dollars continue to shift away from traditional grocery2

- Channel shifting continues in Q1, as traditional grocery scrambles to secure shopper loyalty and engagement

- Price-focused retailers such as discount grocery and Walmart are benefitting the most from multi-channel shopping

- Club and eCommerce are also doing well as subscription services and eCommerce are becoming a norm

The dos and don’ts of omnichannel

88% of retail decision-makers say their company has a digital transformation initiative. Do you?

Here are some dos and don’ts to consider as you build out your omnichannel experience:

DOS

Digital engagement:

- Utilize your website and apps to attract shoppers

- Offer online deli/meal solutions for in-store pickup

- 50%3 of shoppers find this appealing

Seasonal spotlight:

- Leverage the flexible digital environment for assortment changes

- Highlight seasonal items, unique products, and new discoveries

- 99%4 of shoppers use technology to explore fresh options

Personalization pays off:

- Customize the online experience:

- Provide list-building tools

- Suggest related recipes and products

- Offer personalized recommendations

- 70%5 of consumers prefer personalized digital coupons

- 59%5 of customers respond to brand-specific content

DON’TS

Price inconsistency:

- Avoid showing different prices online and in-store

- Customers expect consistency across platforms

Limit promotions:

- Don’t limit promotions to in-store only

- Mirror signage, call-outs, and special pricing online

Ignoring hybrid shoppers:

- 97%6 growth in households using multiple shopping methods

- Remember those who switch from online to offline channels

- Stay agile, connect with shoppers, and thrive in the omnichannel landscape

Maximize Memorial Day produce sales1

47%

of consumers expect to commemorate Memorial Day

80%

of consumers are looking to buy groceries for Memorial Day

63%

of consumers expect to spend $50 or more for Memorial Day

Memorial Day is the unofficial kickoff to summer—a time when families gather, grills are fired up, and outdoor festivities abound. You have a golden opportunity to cater to your customers’ needs during this celebratory season. Here’s how to make the most of it:

- Fresh-cut convenience:

Offer fruit salad cups and vegetable skewers for hassle-free picnics and barbecues

- Salad staples:

Spotlight lettuce, tomatoes, cucumbers, and bell peppers—essential for summer salads. Arrange them prominently to entice shoppers.

- Bundled deals:

Create curated packages with fruit assortments for salads and desserts. Simplify shopping and boost sales.

- Cross-merchandising brilliance:

Group picnic essentials together—whether it’s a juicy watermelon slice or a crisp cucumber. Make it easy for Memorial Day planners!

- Circana Integrated Fresh, Total US, MULO, Calendar Year 2023 Ending 03.24.24

- Circana Panel Data, Total US- all outlets, Calendar Year 2023 Ending 03.24.24

- The Power of Foodservice at Retail 2022 - The Food Industry Association

- Numerator OMNIFUTURE Study, 2023

- 84.51 Study: Omnichannel shopper insights: More ecommerce flexibility than ever

- 84.51 Study: How Brands Can Connect with the Hybrid Shopper